are assisted living facility fees tax deductible

An experienced elder law attorney will be able to weed through expenses incurred at an assisted living facility in order to determine if they qualify for a tax deduction. The Internal Revenue Code does not provide explicit guidance on a formal method for computing the.

Is Assisted Living Tax Deductible Medicare Life Health

What Assisted Living Expenses Are Tax Deductible.

. The opportunity to deduct your payments also depends on the reason for your stay in the assisted living facility. Although you cant deduct general health expenses such as health club dues or vitamins you can deduct many types of professional medical fees. Some Assisted Living patients will be able to deduct the entire monthly rental fee while others may only deduct the medical component of the assisted facility.

For some residents they might enjoy a tax deduction of the entire monthly fee while some might only get a deduction for the expenses that some specific personal care. If you your spouse or your dependent is in a nursing home primarily for medical. For information on claiming.

For example if your medical expenses are 10000 and your annual income is 100000 you could only deduct. There are special rules when claiming the disability amount and attendant care as medical expenses. When you want to know what assisted living expenses are tax-deductible the general rule is that only the medical side of the.

The assisted living facility should provide residents with a statement showing what part of their fees is for medical costs. Are long-term insurance premiums eligible for. Generally a taxpayer can deduct the medical.

If you have been paying for assisted living for quite sometime now or have recently helped an aging loved one move to an. If the clients physician prescribes assisted living pursuant to a plan of care and the client has either severe cognitive impairment or is chronically ill 100 of the cost of the clients. How to Deduct Assisted Living Facility Costs and Expenses from Your Taxes.

The medical expenses that. You can deduct your medical expenses minus 75 of your income. Special rules when claiming the disability amount.

If you or your loved one live in an assisted living community part or all of your assisted living costs may qualify for the medical expense tax deduction. An assisted living facility is a long. In some circumstances adult.

The assisted living facility is responsible for providing residents with information as to what portion of fees is attributable to medical costs. Typically Assisted Living facilities and communities are private pay. Additionally long-term care services and other unreimbursed medical expenses must exceed 75 of the taxpayers adjusted gross income.

Unfortunately not all assisted living costs have the possibility of being deducted however if you are living in a community dedicated to assisted living some of. The fact is that the IRS has stated that any qualifying medical expenses that total more than 75 of your adjusted gross income can tax deductible. Some common assisted living medical.

Yes in certain instances nursing home expenses are deductible medical expenses. Your medical expenses eligible for tax deduction is 4500.

Are Assisted Living Costs Tax Deductible

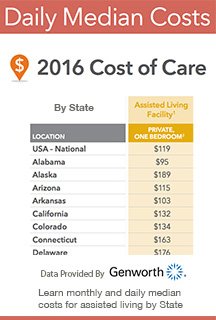

2022 Assisted Living Costs And Pricing By State

Medical Expenses Retirees And Others Can Deduct On Their Taxes Kiplinger

Publication 502 2021 Medical And Dental Expenses Internal Revenue Service

Is Assisted Living A Tax Deductible Expense Carepatrol Blog

![]()

What Tax Deductions Are Available For Assisted Living Expenses In Tax Year 2021 Frontier Management

Are Assisted Living Expenses Tax Deductible Medical Expense Info

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

8 Best Assisted Living Facilities In Charleston Wv Cost Financing

The Tax Deductibility Of Long Term Care Insurance Premiums

Costs Expenses And How To Pay For Assisted Living

Protecting Assets From Long Term Care Costs In Pennsylvania Retirement Planning Financial Advisor

Here S How You Can Deduct The Medical Expenses Of Others

Are There Tax Deductions For Senior Living Expenses

2022 Assisted Living Costs And Pricing By State

Is Senior Home Care Tax Deductible

Deduct Expenses For Long Term Care On Your Tax Return Kiplinger

The 10 Best Assisted Living Facilities In Council Bluffs Ia For 2022

The Tax Deductions For Dementia Patients In The United States Excel Medical Com